federal income tax definition

These taxes are typically applied to a percentage of the income. A tax paid on income over a certain amount.

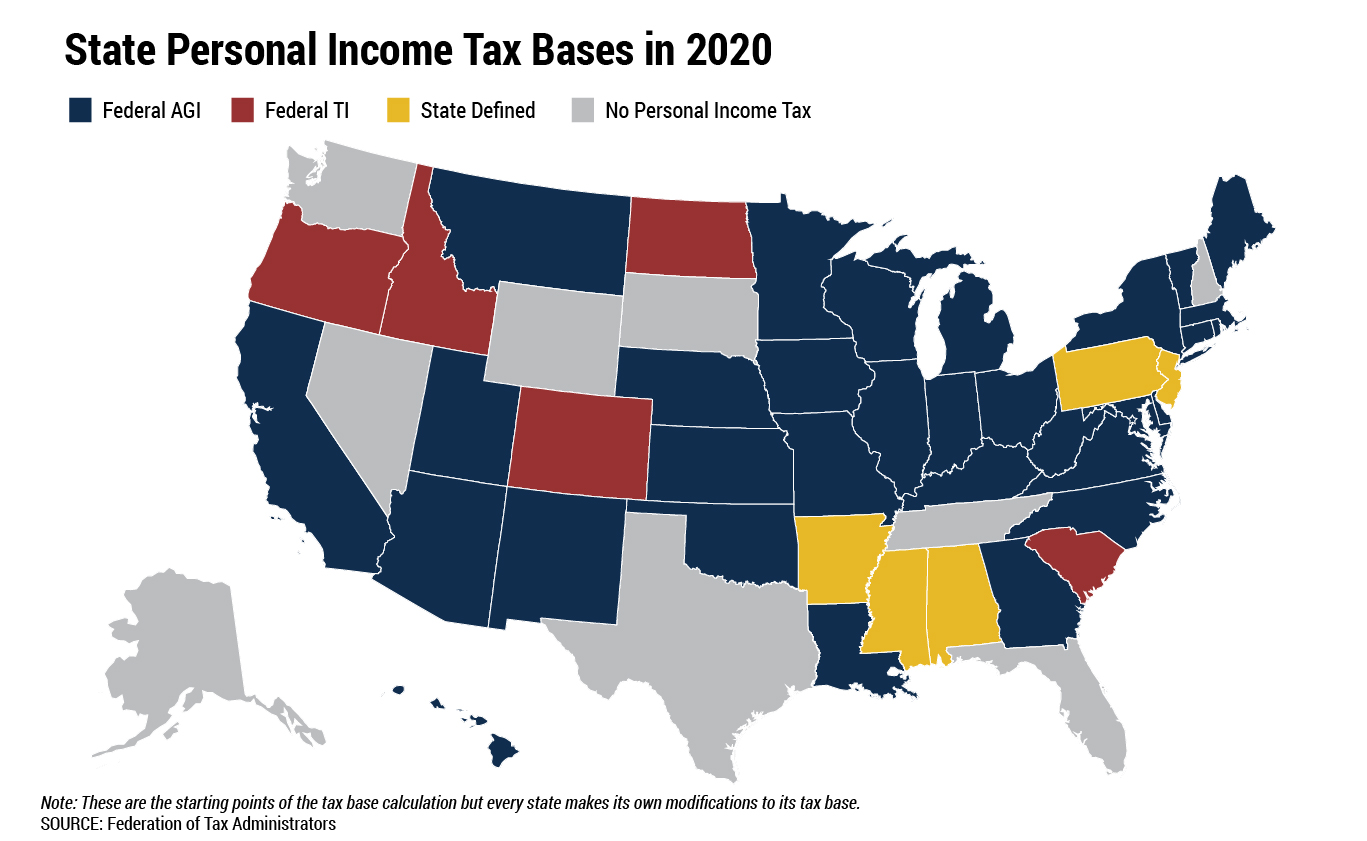

Comparing Flat Rate Income Tax Options For Alaska Itep

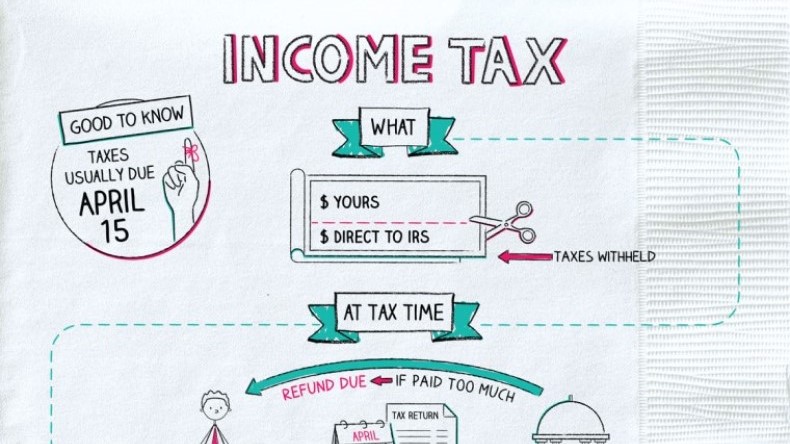

You pay the tax as you earn or receive income during the year.

:max_bytes(150000):strip_icc()/TaxableIncome_Version1_4188122-635a1cf2f69a48f5bdcc697eb075b5a4.png)

. The federal income tax is a pay-as-you-go tax. Income-withholding order means an. To figure out how much tax to withhold use the employees Form W-4.

Federal income tax must be paid as you earn or receive income during the year either through withholding or estimated tax payments. Gross income can be generally defined as all income from whatever source derived a more complete definition is found in. Up to 16 cash back Federal income tax is a tax on income and is imposed by the US.

Employers generally must withhold federal income tax from employees wages. An official form that has to be completed with information about ones income and. What is Tax Withholding.

Check-the-box Entities See Form 8832 and Instructions For Federal tax. If you dont pay enough tax. Federal Income Tax.

Businesses employers must follow the IRS. Some terms are essential in understanding income tax law. Income Tax means any federal state local or foreign income tax including any interest penalty or addition thereto whether disputed or not.

Some investment funds are exempt from. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments. A tax on workers salaries or companies profits that is paid to the US government.

Income can come from a job. A tax levied on the annual earnings of an individual or a corporation. Income tax is a tax that governments impose on income generated by businesses and individuals within their jurisdiction.

Federal income tax meaning. Income taxes are taxes collected by federal state and local governments on the income of individuals and businesses. Impuesto sobre la renta.

The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services. The IRS collects the tax. If youre an employee your.

Refer to Internal Revenue Code section 7701a31 for the definition of a foreign estate and a foreign trust. A tax on workers salaries or companies profits that is paid to the US government. This tax levied on both employers and employees funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Noun C or U GOVERNMENT TAX uk us. Income taxes are levied by the federal government and by a number of state and local governments.

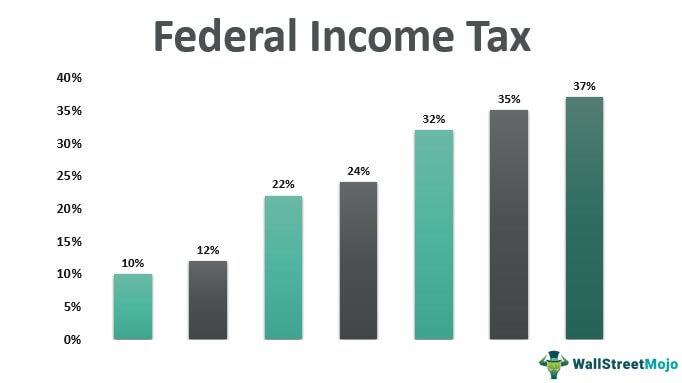

How Do Federal Income Tax Rates Work Tax Policy Center

Federal Income Tax Definition Rates Bracket Calculation

What Is The Standard Deduction Tax Policy Center

:max_bytes(150000):strip_icc()/TaxableIncome_Version1_4188122-635a1cf2f69a48f5bdcc697eb075b5a4.png)

Taxable Income What It Is What Counts And How To Calculate

What Are Income Taxes Napkin Finance

Individual Income Taxes Urban Institute

Government Revenue Taxes Are The Price We Pay For Government

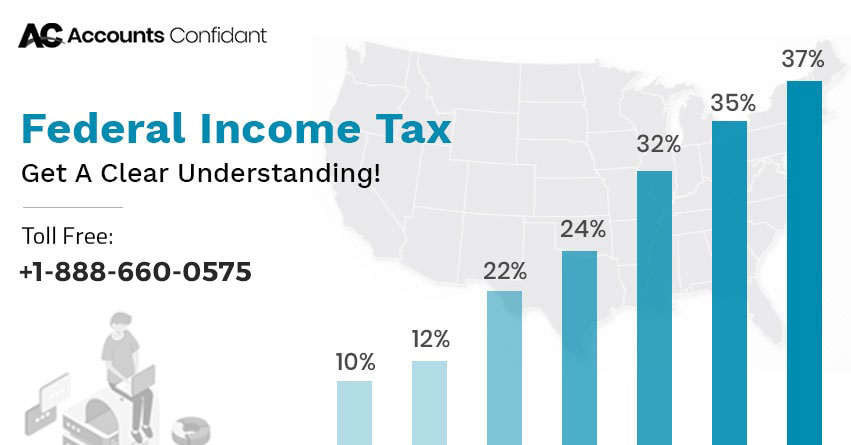

Federal Income Tax Get A Clear Understanding Accounts Confidant

What Is The Tax Gap Tax Policy Center

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

:max_bytes(150000):strip_icc()/Tax_Bracket_Final-ca47afa9764b4cc4bc0b3d2237e972cb.png)

Understanding Tax Brackets With Examples And Their Pros And Cons

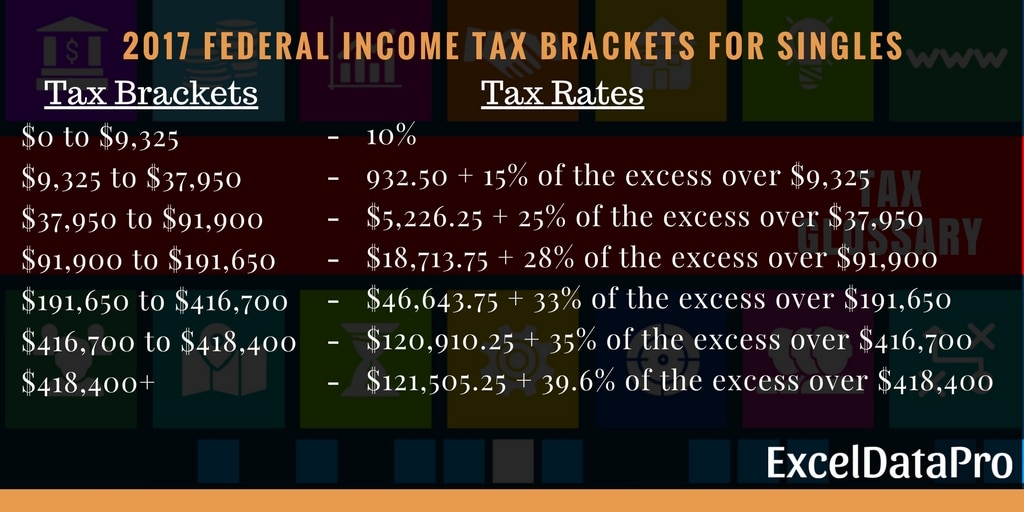

Federal Income Tax Brackets For The Year 2017 Exceldatapro

United State Tax Code History Past And Current Tax Laws

How Federal Income Tax Rates Work Full Report Tax Policy Center

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

:max_bytes(150000):strip_icc()/Marginal_Tax_Rate_Final-bcbd5163da5945a9a2389c7feb94e331.png)

Marginal Tax Rate What It Is And How To Calculate It With Examples

History Of Taxation In The United States Wikipedia

Dealing With Your Federal Income Tax The Definitions Agi Adjusted Gross Income Taxable Income Or Net Income Income On Which Tax Is Computed Or One S Ppt Download

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference